Click

Here to Download PDF Click

Here to Download PDF

|

Accounting for Smash Repairers & Panel Beaters

As you know, repairing a damaged vehicle is a labour intensive process and running a smash repair or panel beating business is hard work. You have to contend with long hours, weekend work, customer deadlines, occupational health and safety issues and insurance companies. You also have to manage apprentices and adapt to technological change in the industry.

We understand the majority of car smash repairers in this country are small, family-owned businesses that employ less than ten people and most panel beaters work with vehicles such as cars, motorbikes, four wheel drives, vans and buses. However, some of our panel beater clients specialise in trucks, boats and even aircrafts while others focus on niche areas including vehicle restorations and modifications to hot rods and muscle cars.

While Manel and the team at PFG Accountants haven't completed a Certificate III in Automotive Vehicle Body Repair they understand the trade and are familiar with the metal working techniques and the specialised tools you use to repair damaged vehicle bodies and manipulate body panels made of various materials including fibreglass, alloys and steels, plastics and carbon fibre.

Your customers expect the perfect finish on the body work of their vehicles so you have to pay attention to detail. Unfortunately, a lot of panel beaters and smash repairers don't pay the same attention to their bookkeeping and tax administration. While GST, BAS and tax payments often represent some of the largest financial obligations for a self employed panel beater, mechanic or auto electrician, many end up paying too much tax and incur fines for late lodgement or non-compliance.

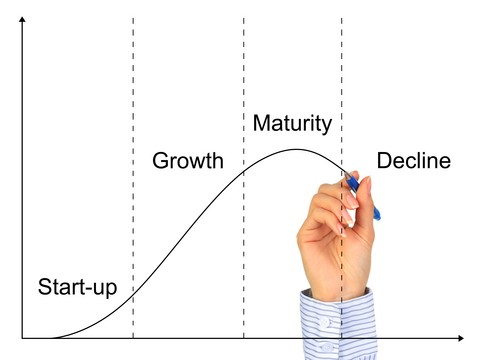

If you're looking for help with your GST, BAS, PAYG and superannuation obligations, we are here to help you cut the cost of compliance. In

addition, we can help you manage your cash flow and train you and your team to use the right software to prepare quotes, invoices and

manage your payroll and apprentices. Having an accountant who understands the auto trade can potentially mean the difference between just

surviving and potentially thriving. Over the past decade, Manel and her team of accountants have mentored a number of smash repairers, motor

mechanics and auto electricians through the various stages of their business life cycle – from start up right through to sale.

If you're looking for help with your GST, BAS, PAYG and superannuation obligations, we are here to help you cut the cost of compliance. In

addition, we can help you manage your cash flow and train you and your team to use the right software to prepare quotes, invoices and

manage your payroll and apprentices. Having an accountant who understands the auto trade can potentially mean the difference between just

surviving and potentially thriving. Over the past decade, Manel and her team of accountants have mentored a number of smash repairers, motor

mechanics and auto electricians through the various stages of their business life cycle – from start up right through to sale.

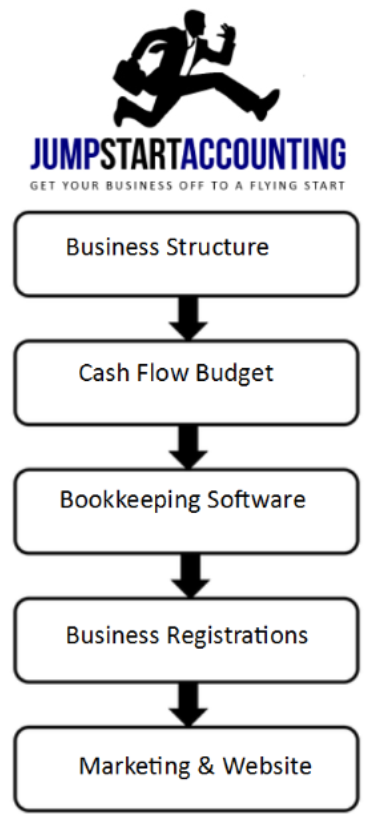

THINKING OF STARTING A MOTOR MECHANIC or AUTO ELECTRICIAN BUSINESS?

Starting a business is a bit like building a house and the foundations of your business are your taxation

structure,

accounting software and marketing. Your choice of business structure is critical and there are a number of different options such as sole

trader, partnership, company and trust. When selecting the right business structure asset protection is a key consideration because of the

risks associated with the smash repair industry. We also take into consideration your family profile, future profit projections and plans

regarding admission of new business partners.

Starting a business is a bit like building a house and the foundations of your business are your taxation

structure,

accounting software and marketing. Your choice of business structure is critical and there are a number of different options such as sole

trader, partnership, company and trust. When selecting the right business structure asset protection is a key consideration because of the

risks associated with the smash repair industry. We also take into consideration your family profile, future profit projections and plans

regarding admission of new business partners.

Accounting software selection is another brick in the foundation wall. Again, the wrong choice can be catastrophic because poor business

records is one of the biggest causes of business failure in this country. You need up to date, accurate financial records to make informed

business decisions which is why we insist your accounting software matches your business needs and level of accounting skill. Using

sophisticated double entry accounting software without a reasonable level of accounting skill will simply create a computerised shoebox. We

aim to minimise the cost of compliance for our clients but shoebox records defeat the purpose and once we evaluate your business needs and

skills we then train you to use the software. Here at PFG Accountants & Advisors, we want to be your accountant and business advisor,

not a bookkeeping service.

Accounting software selection is another brick in the foundation wall. Again, the wrong choice can be catastrophic because poor business

records is one of the biggest causes of business failure in this country. You need up to date, accurate financial records to make informed

business decisions which is why we insist your accounting software matches your business needs and level of accounting skill. Using

sophisticated double entry accounting software without a reasonable level of accounting skill will simply create a computerised shoebox. We

aim to minimise the cost of compliance for our clients but shoebox records defeat the purpose and once we evaluate your business needs and

skills we then train you to use the software. Here at PFG Accountants & Advisors, we want to be your accountant and business advisor,

not a bookkeeping service.

As you know, to build a house you also need the right tools. When constructing your business we also use a number of tools including our business start up checklist and our start-up expense checklist to identify all your potential establishment costs. It dissects your start up costs into several categories including:

- tools

- tools

- equipment

- IT expenses

- professional fees and

- marketing costs.

These figures can then be transferred into a cash flow budget template to produce a projected trading statement for your first year of operations. For a smash repairer, your van, tow truck or ute is arguably one of your most important business tools. You can download our Motor Vehicle Tax Guide from the resources section of our website to learn more about the alternative methods of claiming your vehicle expenses and the distinction between a business and private trip. In addition, through our affiliate partners we can also assist with vehicle finance (chattel mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of dollars.

As accountants, we can do some financial modelling and prepare some ‘what if’ scenarios so you understand your best and worst case profit scenarios. Next, using industry benchmarks we can compare the performance of your business against your peers so you understand what is working in the business and what areas need working on.

As a business start-up there are numerous issues to consider including site selection, tax

registrations, insurances, the lease of the premises as well as health and safety regulations. We can assist you in all of these areas plus

provide advice on HR matters, payroll and the preparation of a business plan. Over the past two decades our team of accountants have

helped dozens of smash repairers, motor mechanics and auto electricians get their business off to a flying start. We offer you experience,

technical tax knowledge and most importantly, an intimate understanding of your industry.

As a business start-up there are numerous issues to consider including site selection, tax

registrations, insurances, the lease of the premises as well as health and safety regulations. We can assist you in all of these areas plus

provide advice on HR matters, payroll and the preparation of a business plan. Over the past two decades our team of accountants have

helped dozens of smash repairers, motor mechanics and auto electricians get their business off to a flying start. We offer you experience,

technical tax knowledge and most importantly, an intimate understanding of your industry.

MARKETING YOUR BUSINESS

For small business owners, your marketing can be the difference between gloom, doom and boom.

Most panel beaters and smash repairers rely on their reputation and referrals to grow their business. While these ingredients remain important, you need to shift your marketing focus online. Increasingly local searches like ‘Panel Beater Bankstown’ are driving traffic to your website and often your website is the first touch point with a potential new customer. As you know, you only get one chance to make a good first impression and your website is your 'shopfront' and silent sales person working 24/7 to promote your business.

One of our biggest points of difference compared to other accounting firms is our marketing expertise. We can assist you with your branding (business name, logo and slogan), your corporate brochure and help you harness the power of social media to win more referrals. Over the past few years we have worked with dozens of clients to help them create affordable, quality lead generation websites that are responsive to smart phones and tablets. We can provide advice and guidance with your website content including video production and if your website lacks calls to action or lead magnets we'll help you build them. In addition, we'll introduce you to strategies like re-marketing and search engine optimization to drive more traffic to your website.

If you aren’t using some of these marketing techniques your business probably won't reach its full profit potential.

The marketing process begins with your branding and we have worked through the process with dozens of clients over the years and using some

online resources we can help you build a modern brand that resonates with your target market. We can even help you develop your stationery

at a fraction of the cost of engaging a graphic artist or marketing consultant.

The marketing process begins with your branding and we have worked through the process with dozens of clients over the years and using some

online resources we can help you build a modern brand that resonates with your target market. We can even help you develop your stationery

at a fraction of the cost of engaging a graphic artist or marketing consultant.

Most importantly, we recognise the fact that business owners like you want more sales, more customers and more profit so we also give you

access to one of the world’s most successful marketing programs, the ‘Business Growth System’. It contains more than 80 breakthrough

marketing strategies supported by videos, templates, checklists and 2,500 pages of instructions. Access to this ‘vault’ of resources would

normally cost you $500 per month, however, as a client of PFG Accountants & Advisors you get FREE access. In addition,

you also get unlimited access to the ‘Grow Your Business in 5 Days’ video training course that could have a massive impact on your future

business growth. That's over $7,000 of valuable tools the moment you join us.

It's important that you understand the Four Ways to Grow A Business

so you know the key profit drivers in your business. We can walk you through a number of profit improvement strategies and even quantify

the profit improvement potential in your business. Our role is to make sure you don't leave any profit on the table and if you're an auto

electrician, motor mechanic or run a smash repair business we offer you a range of accounting, taxation and business coaching services

including:

- Start-Up Business Advice for Motor Mechanics, Auto Electricians and Smash Repairers

- Advice regarding the Purchase or Sale of your Business

- Tools including the Start-Up Expense Checklist and Templates for a Business Plan, Cash Flow Budget, Letterhead and Business Card

- Advice and Assistance with the Establishment of Your Business Structure

- Tax Registrations including ABN, TFN, GST, WorkCover etc.

- Preparation of Business Plans, Cash Flow Forecasts and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, Quotes & Payroll

- Preparation and Analysis of Financial Statements

- Preparation of Finance Applications

- Bookkeeping and Payroll Services

- Income Tax Returns and Tax Planning Strategies

- Wealth Creation Strategies and Financial Planning Services

- Industry Benchmarking and KPI Management

- Vehicle & Equipment Finance (Chattel Mortgage & Lease)

- Assistance with your Marketing including your Branding, Corporate Brochure and Website

- Monitoring and Controlling Labour and Sub-Contractor Costs

- Advice & Assistance with Pricing your Services and Claiming Vehicle Expenses

- Recession Survival Strategies

- Advice regarding Employee Relations and Workplace Laws

- Business & Risk Insurances (Income Protection, Life Insurance etc.)

- Business Succession Planning

Here at PFG Accountants & Advisors, we do more than just keep the score for smash repair business owners. We are business and profit builders who genuinely care about the success of your panel beating business. We view your tax return as the start of the client process, not the end and if you're looking to grow your business, your profits and your wealth we invite you to contact us today.

We understand the auto trade and currently service the accounting and taxation needs of a number of mechanics, auto electricians, tyre

dealers and smash repairers from around Australia. If you’re looking to get your business off to a flying start or want to book your

business in for a ‘service’, we invite you to book a FREE, one hour introductory consultation to discuss your business

needs. You can expect practical business, tax, marketing and financial advice that could have a significant impact on your bottom line. To

book a time, call us today on (02) 9791 1779 or complete your details in the box at the top of this page and let's get to work ON your

business so it is more profitable, valuable and saleable.

We understand the auto trade and currently service the accounting and taxation needs of a number of mechanics, auto electricians, tyre

dealers and smash repairers from around Australia. If you’re looking to get your business off to a flying start or want to book your

business in for a ‘service’, we invite you to book a FREE, one hour introductory consultation to discuss your business

needs. You can expect practical business, tax, marketing and financial advice that could have a significant impact on your bottom line. To

book a time, call us today on (02) 9791 1779 or complete your details in the box at the top of this page and let's get to work ON your

business so it is more profitable, valuable and saleable.